Why Median Home Sales Price Is Confusing Right Now

The National Association of Realtors (NAR) is set to release its most recent Existing Home Sales (EHS) report tomorrow. This monthly release provides information on the volume of sales and price trends for homes that have previously been owned. In the upcoming release, it’ll likely say home prices are down. This may seem confusing, especially if you’ve seen other blogs saying home prices have hit bottom and have since rebounded.

So, why would this say home prices are falling when others report they’re going up? It all depends on methodology. NAR reports on the median home sales price, while others use repeat sales prices. Here’s the difference:

The Center for Real Estate Studies at Wichita State University explains median prices like this:

“The median sale price measures the ‘middle’ price of homes that sold, meaning that half of the homes sold for a higher price and half sold for less . . . For example, if more lower-priced homes have sold recently, the median sale price would decline—even if the value of each individual home is rising.”

Investopedia defines the repeat sales approach this way:

“Repeat-sales methods calculate changes in home prices based on sales of the same property, thereby avoiding the problem of trying to account for price differences in homes with varying characteristics.”

The Challenge with the Median Home Sales Price Today

As the quotes show, different approaches tell different stories. That’s why median price data (like EHS) may show a decline, even though repeat sales reports show prices are appreciating again.

Bill McBride, author of the Calculated Risk blog, sums it up like this:

“Median prices are distorted by the mix and repeat sales indexes like Case-Shiller and FHFA are probably better for measuring prices.”

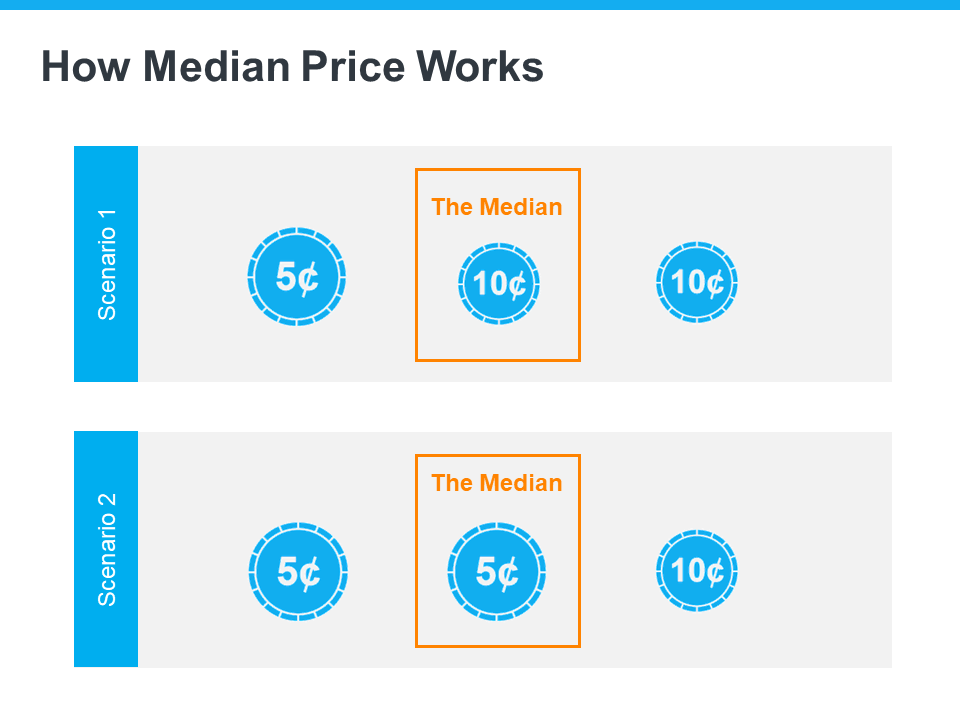

To drive the point home, here’s a simple example: let’s say you have three coins—one nickel and two dimes. The median value is 10 cents. But if you have two nickels and one dime, the median drops to five cents. The value of the coins didn’t change—only the mix did.

In both cases, a nickel is still worth five cents and a dime is still worth 10 cents. The value of each coin didn’t change.

This is why using the median home sales price as a gauge can be misleading right now. While most people start with the price when budgeting, what they truly base their purchase on is the monthly mortgage payment. When mortgage rates rise, buyers may choose more affordable homes to keep payments within reach.

That’s why a greater number of ‘less-expensive’ homes are selling—and that’s pushing the median price down. It doesn’t mean homes are losing value.

So when you see headlines about prices dropping, remember the coin analogy. It’s not that values are falling—it’s the shift in which types of homes are being sold, due to affordability and current mortgage rates.

Bottom Line

For a deeper understanding of home price trends, connect with a local real estate professional.