How Inflation Affects the Housing Market

Have you ever wondered how inflation impacts the housing market? Believe it or not, the two are closely connected. When one moves, the other often follows. Here’s a high-level look at how they’re linked.

Have you ever wondered how inflation impacts the housing market? Believe it or not, the two are closely connected. When one moves, the other often follows. Here’s a high-level look at how they’re linked.

The Relationship Between Housing Inflation and Overall Inflation

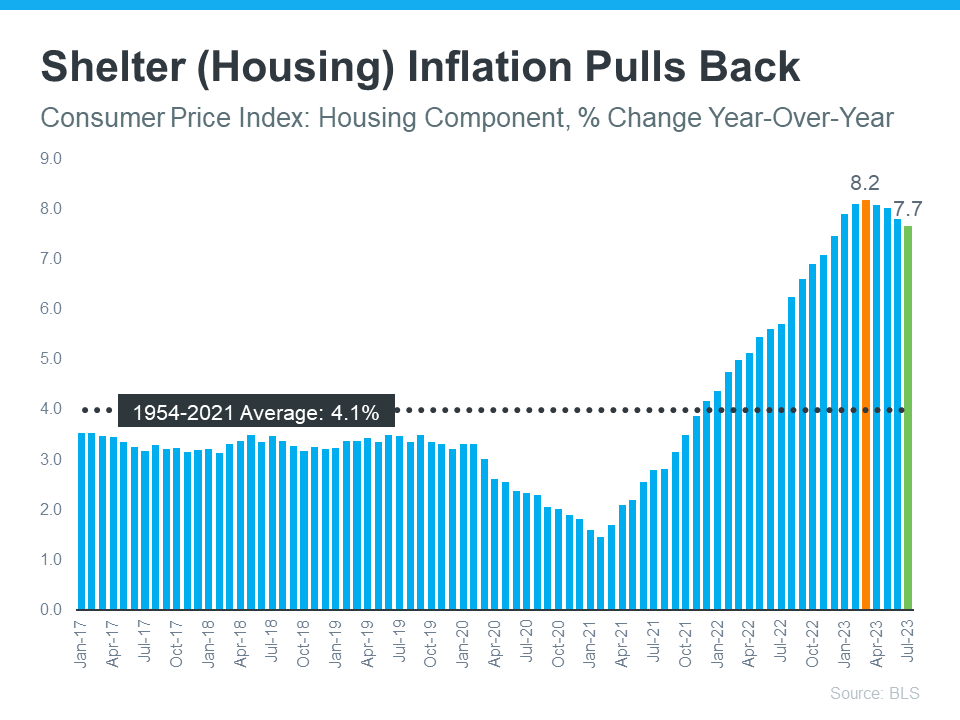

Shelter inflation measures housing-related price growth and is based on a Bureau of Labor Statistics (BLS) survey of renters and homeowners. Renters report their actual rent; homeowners estimate what they’d pay to rent their own home.

Just like general inflation tracks everyday expenses, shelter inflation tracks housing costs—and it’s been declining for four months straight (see graph below):

This matters because shelter inflation makes up about one-third of the Consumer Price Index (CPI). When it shifts, it significantly influences overall inflation. The current dip suggests that overall inflation could decline in the months ahead.

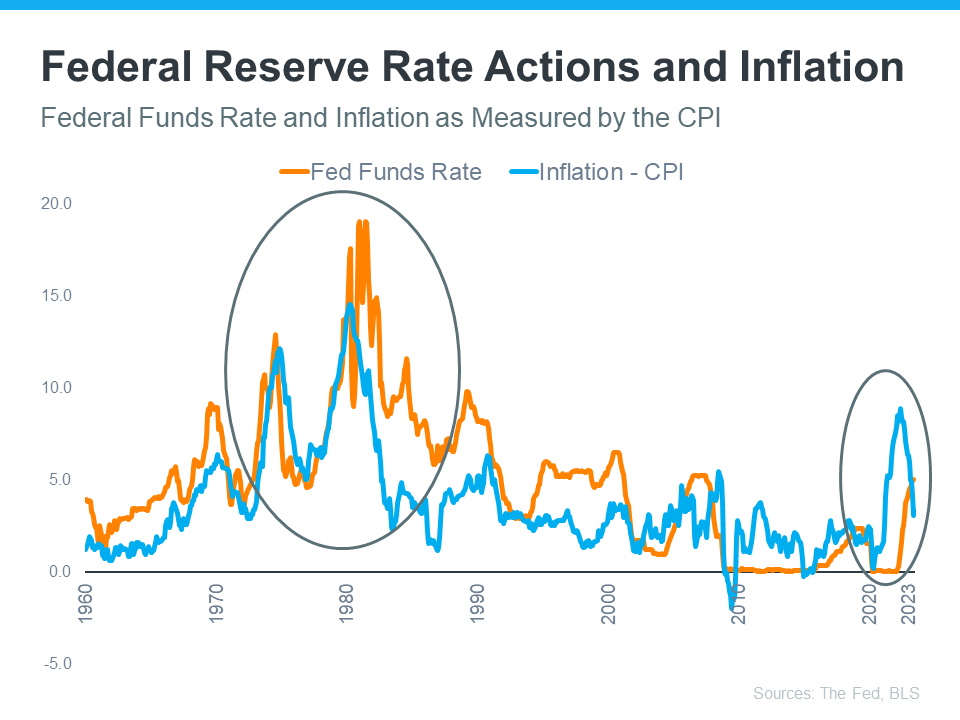

This would be welcome news for the Federal Reserve, which has worked to tame inflation since early 2022. While inflation peaked at 8.9%, the latest figure is 3.3%. Their target is 2%.

Inflation and the Federal Funds Rate

To combat inflation, the Fed has raised the Federal Funds Rate, which affects how much banks pay to borrow from each other. When inflation rises, so does the Fed’s rate to help cool the economy.

The graph shows inflation spikes (blue) and how the Fed has responded by raising the rate (orange). Recently, those efforts have helped moderate inflation. As inflation nears the 2% goal, the Fed may slow or stop rate hikes.

A Brighter Future for Mortgage Rates?

What does this mean for you? While the Fed doesn’t set mortgage rates directly, it does influence them. As Mortgage Professional America explains:

“. . . mortgage rates and inflation are connected, however indirectly. When inflation rises, mortgage rates rise to keep up with the value of the US dollar. When inflation drops, mortgage rates follow suit.”

Although mortgage rate predictions are never certain, signs of easing inflation are encouraging—and could signal better conditions ahead for buyers.

Bottom Line

Whether you’re planning to buy, sell, or simply stay informed, now is the time to connect with a trusted local real estate expert who can guide you through changing market conditions.